In the latest developments concerning USDCAD, the currency pair drifted lower to 1.3520 amid a weakened US Dollar during Thursday's early Asian trading hours. The decline was attributed to softer-than-expected US March ISM Services PMI data, which eased to 51.4 from 52.6 in February. Additionally, the surge in crude oil prices to their highest levels since October bolstered the commodity-linked Canadian Dollar.

Furthermore, yesterday's weaker-than-expected US ISM Services PMI data for March weighed on the Greenback, exerting downward pressure on the USDCAD pair.

Today's key economic indicators include the USD Initial Jobless Claims, with a forecast of 52.8 compared to the previous 52.6, and the CAD Trade Balance, with a forecast of 0.70B versus the previous 0.50B.

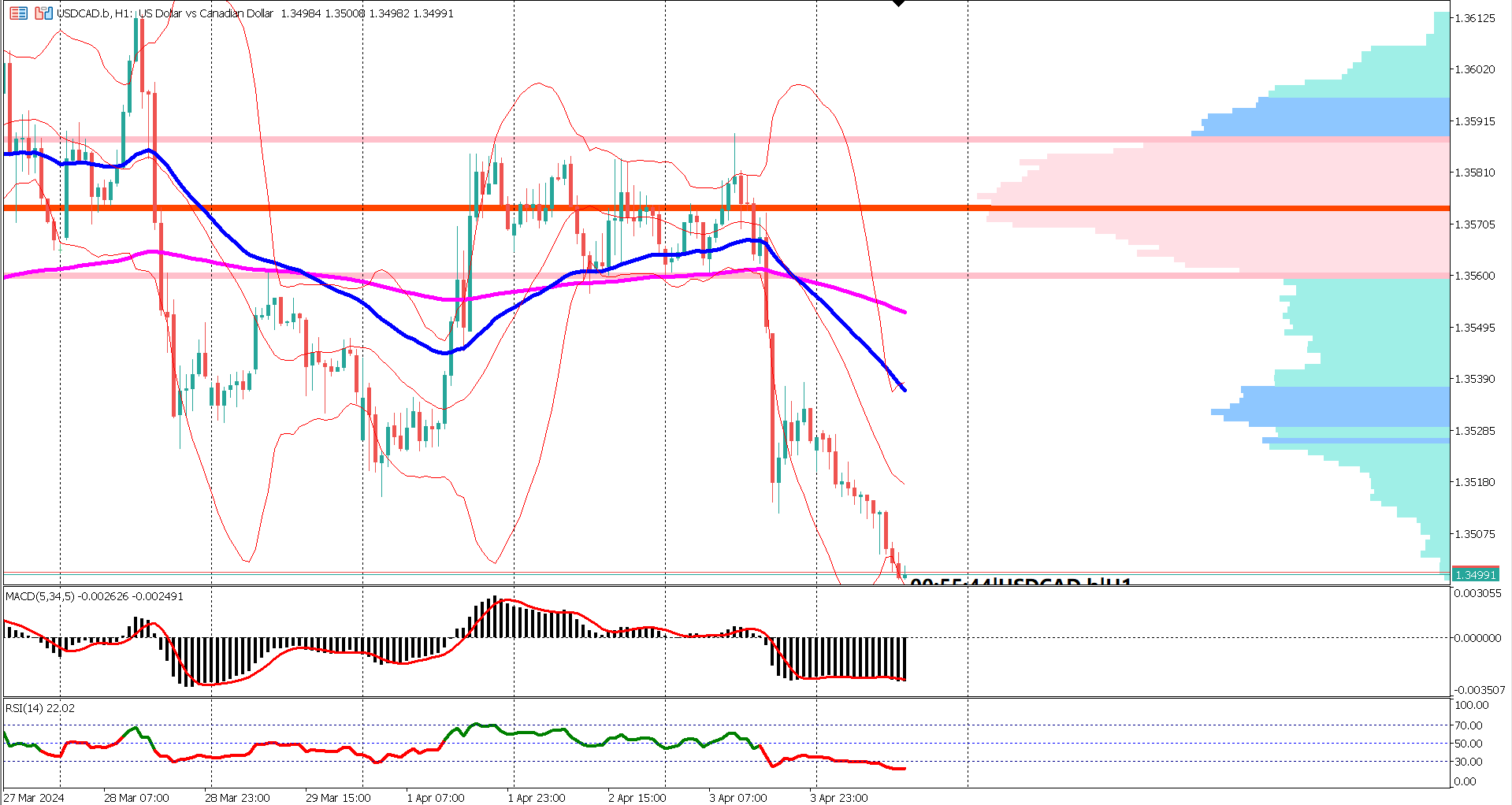

A technical analysis of the 1-hour timeframe chart reveals a bearish outlook for the USD against the CAD. The Exponential Moving Averages (EMA) 50 and 200 have formed a death cross, signaling a strong bearish signal. Moreover, the market is trading below the value area of the volume profile, suggesting a downward trend. Support levels are anticipated around 1.3500, with the Relative Strength Index (RSI) indicating oversold conditions, potentially signaling nearby support. The Moving Average Convergence Divergence (MACD) signal line is steadying, hinting at a possible market rebound.

In summary, the USDCAD pair remains bearish and is likely to rebound, considering its trading position far below the value area and its proximity to the psychological level at 1.3500. Traders are advised to closely monitor key economic indicators and technical signals for further insights into the pair's trajectory.

Forecast 52.8 vs Previous 52.6

Forecast 0.70B vs Previous 0.50B

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.