The middle of this week witnessed a flurry of economic releases, with the US GDP stealing the spotlight by outperforming expectations at 5.2% versus the forecasted 4.9%. This positive momentum extended to Core PCE and Initial Jobless Claims, aligning with economists' expectations. Meanwhile, Canada's GDP also exceeded predictions at 0.1% versus 0.0%, indicating resilience in the Canadian economy.

Surprisingly, despite these strong fundamentals, USDCAD has remained relatively weak. The dichotomy between robust economic indicators and the currency's performance adds a layer of complexity to the forex landscape, leaving traders to decipher conflicting signals.

Looking ahead, tonight's release of Canada's Employment Change and Unemployment Rate is eagerly anticipated. Economists are expecting a slowdown in employment change at 15K versus the previous 17.5K and an uptick in unemployment at 5.8% versus the previous 5.7%. Simultaneously, the US will unveil crucial economic data, including ISM Manufacturing PMI and ISM Manufacturing Prices. Forecasts predict increases in both metrics.

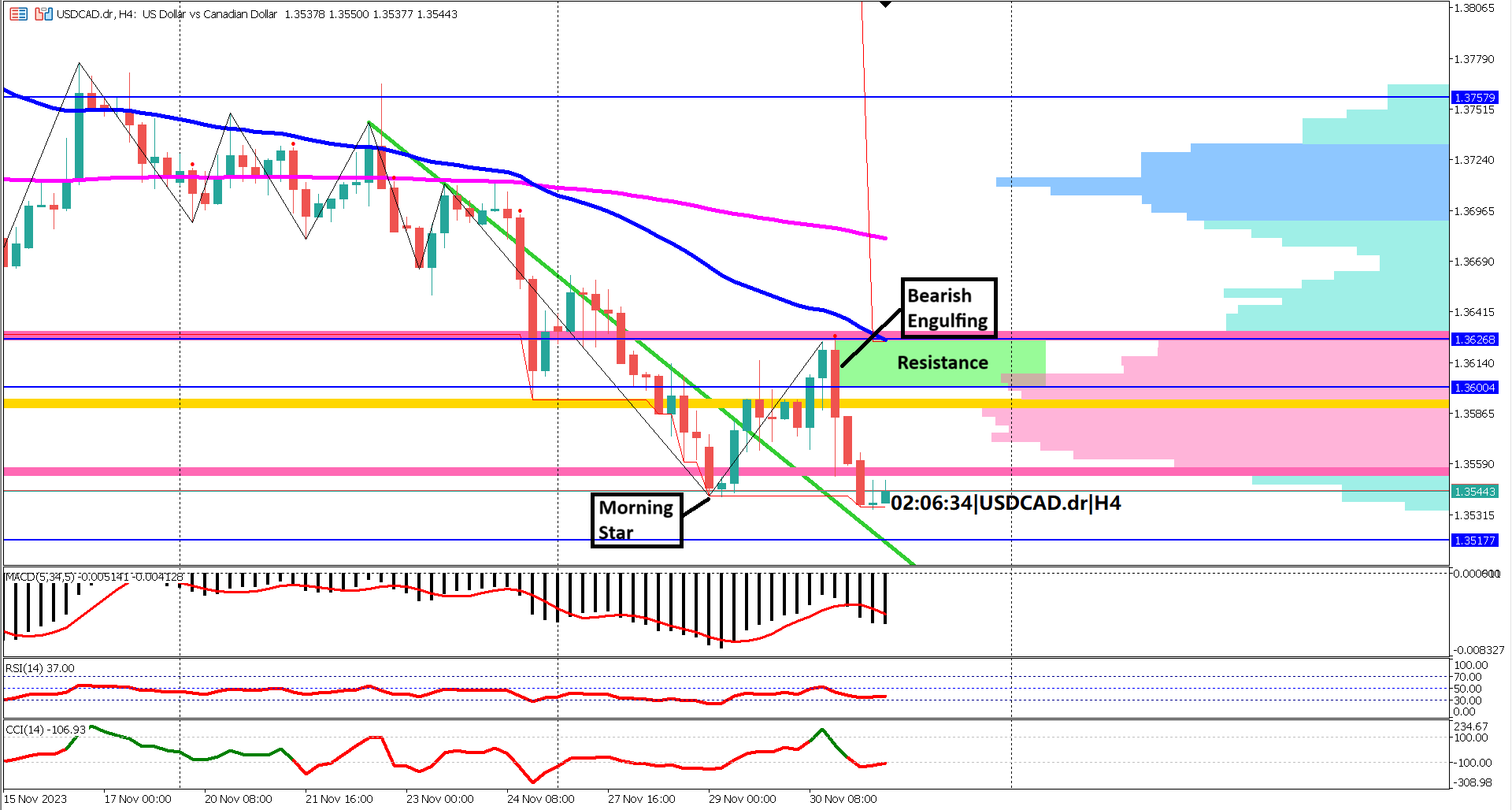

Turning to price action analysis on the 4-hour chart, USDCAD finds itself below the EMA 50 and EMA 200, both of which are expanding, reinforcing the prevailing bearish trend. The recent death cross further emphasizes the bearish sentiment. The volume profile, represented by pink bars, echoes this sentiment as the price currently is below the value area.

Despite a fleeting morning star candlestick pattern, a subsequent bearish engulfing formation indicated the proximity of dynamic resistance at the EMA 50. The CCI indicator briefly turned bullish but reverted to a bearish stance with the appearance of the bearish engulfing candlestick. Both the MACD and RSI continue to signal bearish momentum, underscoring the resilience of the bearish trend.

In conclusion, while robust fundamentals may suggest a stronger USD against the CAD, the technical landscape remains dominated by bearish signals. Traders should exercise caution and closely monitor tonight's key economic releases, as any surprises may tip the scales and influence USDCAD's trajectory in the forex market.

Forecast 15k vs Previous 17.5k

Forecast 5.8% vs Previous 5.7%

Forecast 47.6% vs Previous 46.7%

Forecast 46.2% vs Previous 45.1%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.