The pound sterling strengthened against the USD despite the US Consumer Price Index and Inflation rate coming out lower than expected; the data indicates there was lower economic activity for the US dollar, although the US economy overall is reporting to be more healthy and stable than speculated. The release also cuts down odds that the country's Fed will hike the Interest Rate, at least in the near term.

The US is scheduled to release the Producer Price Index on Thursday; analysts are anticipating data will report a 0.9%, decreasing from the previous 1.1%. The US labor market is expected to continue to be strong; Jobless claims expert consensus expect claims to come in at 1,407K, lower than the previous 1,416K amount.

The UK will release high-impact economic indicators on Friday; Gross Domestic Product is expected to significantly decrease from 0.5% to -1.3%, affecting the value of the GBP against other currencies. Moreover, GDP Growth Rate YoY is likely to decline from 8.7% to 2.8%, while the GDP Growth Rate QoQ consensus is a -0.2%.

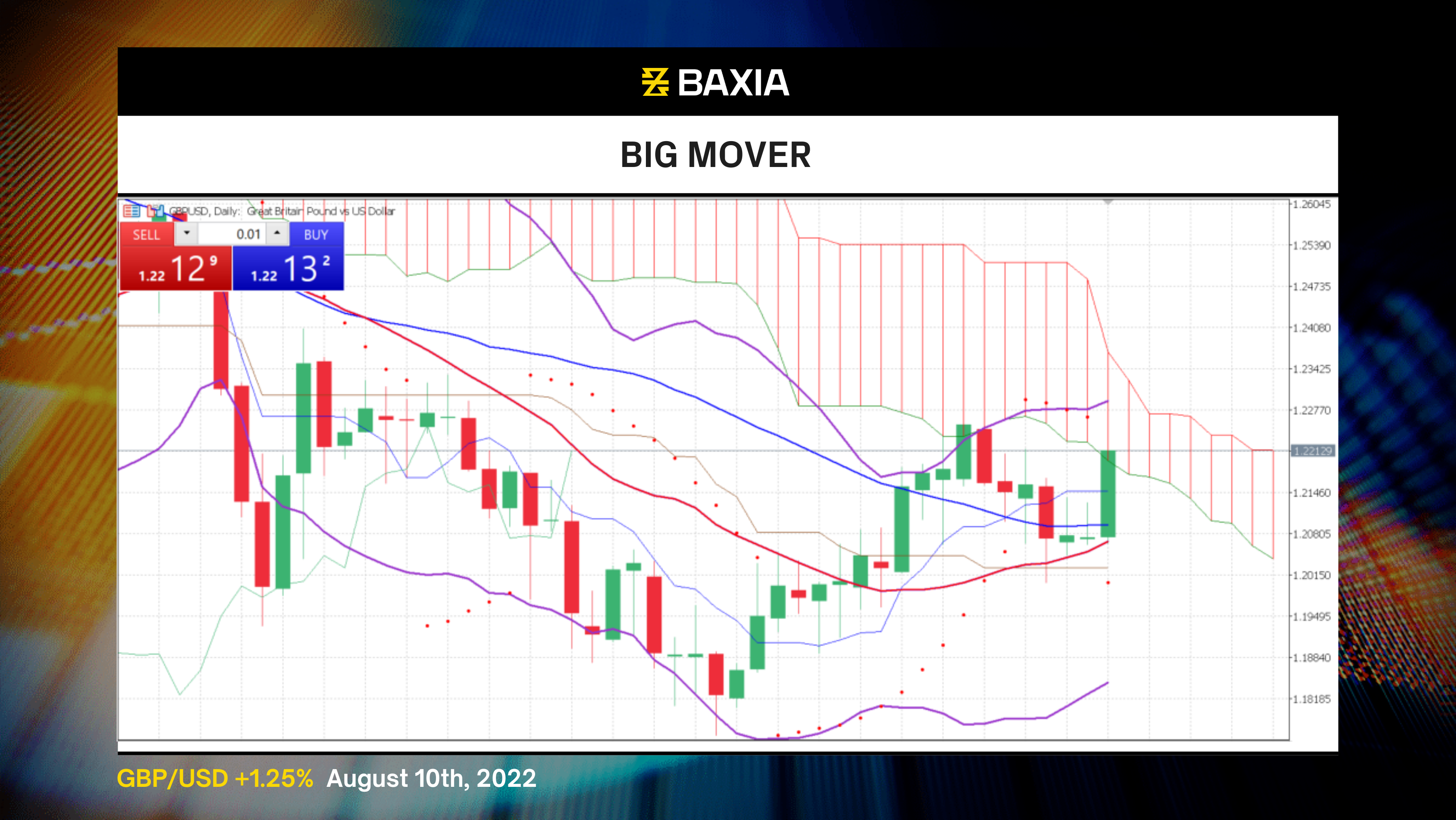

The GPBUSD uptrend has been resuming after a pullback brought down the price by 1.4% over the past four days; now, the pair is trading above the short and long-term moving averages.

The Bollinger bands are wide; high volatility will continue for the short term, and the bands are also starting to move upwards, suggesting that the uptrend is likely to continue for the medium term. The price could find resistance close to the upper band at 1.22932, but as it continues expanding, the resistance will also move upwards.

The price is entering the Ichimoku cloud, an area often considered to bring market uncertainty; however, the pair’s momentum is high and broke two resistance levels from our 38.2% and 23.6% Fibonacci retracements.

The relative strength index is at 59%, giving GBPUSD enough room to continue rallying in the short term. Once the RSI gets closer to 70%, we could see a price correction. Our parabolic SAR indicator also suggests that the uptrend will continue.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.